What is a Voice of the Child Report?

July 16, 2020 By Kimberly Costa Voice of the Child Report (a “Report”), also known as Focused Children’s Lawyer Reports (those prepared through the Office of the Children’s Lawyer), is a relatively new development in family law matters in Canada. There is now a greater recognition of the importance of the voices of children and […]

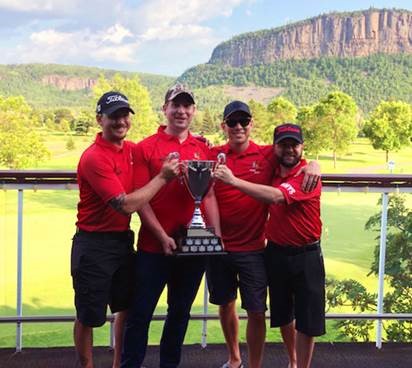

Weilers Wins Law Association Golf Tournament

The lawyers came out swinging at this year’s annual Thunder Bay Law Association Golf Tournament. The annual event was held at Fort William Golf and Country Club, and we are happy to announce that the 2019 trophy belongs to Weilers! Pictured: Reese Little, Jonathan Clark, Mark Mikulasik and Evan Juurakko.

Changes To Odsp Allows For More Freedom In Long-term Planning For A Loved One Living With A Disability

July 25, 2018 By Paul Jasiura Estate planning provides you with the opportunity to ensure your loved ones are taken care of in the long term. However, when a loved one is living with a disability, and is receiving income support from the Ontario Disability Support Program (ODSP), proper estate planning is even more essential to […]

Have You Checked Your Tires Lately?

November 30, 2017 By Brian Babcock The owner of a vehicle has a responsibility to make sure that their vehicle is safe to operate. This includes the condition and inflation of the tires. On November 21, 2017, the Court of Appeal decided an unusual case, House v. Baird in which the owner of a vehicle being driven by […]

Let The Buyer “Beware”

October 30, 2017 By Brad Smith Ghosts and goblins can play a role in the law. There is Latin phrase, caveat emptor, which means, let the buyer beware. This was never so true in a recent court case, 1784773 Ont. Inc. v K-W Labour Association et al. After selling some property, the seller reported in the local […]

Relief Denied: Freedom Of Contract Affirmed

October 27, 2017 By Brian Babcock In a recent article, I explained how the Ontario Court of Appeal had clarified the law of “relief from forfeiture.” Now, the Court has considered the importance of confidence that bargains will be enforced. This means that relief from forfeiture must be rare, and subject to defined principles. Relief from forfeiture […]

Changes To Ontario Disability Support Program

September 20, 2017 By Paul Jasiura Co-authored by Adam Castonguay (Law Student, Bora Laskin Faculty of Law) Disabled persons in Ontario are eligible for income support benefits through the Ontario Disability Support Program (ODSP). In order to ensure that only people in need receive the benefits, there is a limit on the assets owned by the recipients and […]

Taylor Swift And A Dollar In Damages

August 15, 2017 By Brian Babcock Taylor Swift only sued for one dollar in damages in her counter-suit for assault against the former radio DJ who had sued her for allegedly ruining his career. Odds are you know the story. In most cases involving sexual assaults, the damages will be more than one dollar. In fact, […]

The Meaning And Effect Of Hiring An Employee On Probation

July 18, 2017 By Brad Smith There is a presumption that an indefinite employment contract can be terminated by providing the employee with reasonable notice. This includes short-term employees. This presumption is overcome if the parties agree to a period of probation. The Ontario Court of Appeal has clarified the meaning of a probationary employee and […]

Beware The Will-Kit Part II: Powers Of Attorney

June 15, 2017 In my first post, “Beware the Will-Kit: The Costly Consequences of a $9.99 Will“, I discussed the importance of a lawyer-made Will. The same principle applies, if not more so, to Powers of Attorney. Similar to Wills, there are very specific legislative requirements as to the proper execution of Powers of Attorney, and […]